THE CALANDRA REPORT

Ivanhoe Mines Teases All-Time High | Koryx Copper | CanAlaska Uranium

Plus: $100 Silver Bonus Straight From London (& Italia)*

See The Calandra Report Stalwarts,

Largest Stakes, Spec-Trekkers & Future Metals

Mega-Millionaires at close of this

report please.

Copper. Big gains this week, TCRs. UPDATED FRIDAY, SEPT. 27, & THURSDAY SEPT. 26.

Gold’s futures contract notched $2,705 Thursday, then pared its gain. Copper rose 3%. to $4.64 a pound.]

[Copper is a global gauge for all economic growth … or shrinkage. Perhaps even better than oil prices. For us here at The Calandra Report , gauging the copper gauge — Ivanhoe Mines IVN IVPAF and a report of Zijin Mining, a China partner, desiring a possible expansion at copper mine Kamoa-Kakula. See here please.]

Copper summary — from London broker IG:

“The news of China’s stimulus has supercharged copper, pushing it to its highest level since mid-July. Further gains would target the highs from early July.”

That is the big-pic. Mine is the specific pick, in our The Calandra Report, and for 2 decades, DRC Congo copper-zinc producer Ivanhoe Mines IVPAF IVN.

[As stated, we plan an intended IVPAF sale for the funding of our family trust (targeted stock: 30,000 shares in a taxable account of a total 86,000 shares in various taxable and retirement accts).

We intend to purchase back some of those IVPAF / IVN shares for retirement accounts. Friday, I reduced an open sell order to now sell 4,000 shares at $21.20 CAD. ]

FRIDAY: IVN shares rising 1% AFTER rising approx. 6% Thursday and now at $20.57 a share.

On Friday, we sold, 2,000 shares at $20.57 CAD a share.

Also regarding specific copper picks: EMX Royalty EMX, holder of several copper net smelter returns, most potently the Serbia Timok producing copper-gold-etc. mine operated by China’s Zijin.

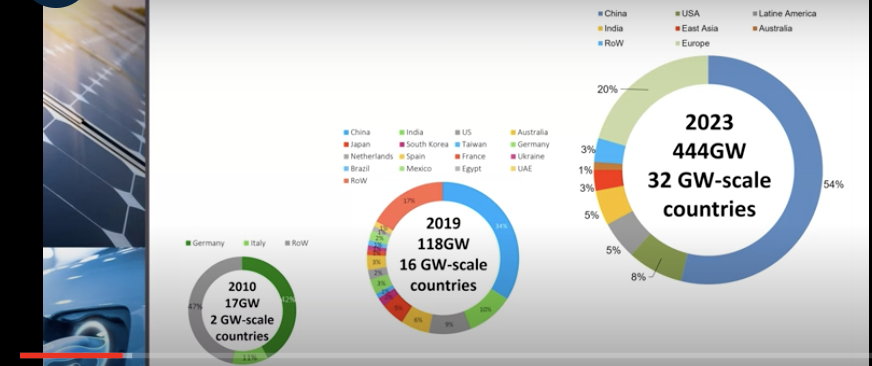

* Silver’s Solar Lining: Simon Catt at Arlington Group in London gathered silver execs, researchers and reporters in advance of Arlington’s Rapallo, Italy, conference (held last week).

Simon Catt & Arlington Group team have been working the China-solar supply and silver construct for at four years running.

— Uranium: commercial banks are embracing nuclear fuel. Explorers and producers are staging a 4-day rally. Bill Sheriff of enCore Energy EU (Texas), and Cory Belyk of CanAlaska Uranium CVV CVVUF, telling me about China, and the world’s, AI (energy-dependent artificial intelligence growth):

“Without nuclear there is no AI.” — Bill Sheriff

“It is nice to see the large financial institutions show visible support for the growth of nuclear energy. Their support is critical to getting projects backed with funding for nuclear buildout,” says Cory Belyk at CanAlaska.

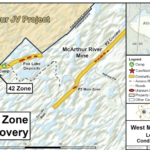

Big hits for CanAlaska revealed Thursday at West McArthur project. See the Pike Zone numbers here.

“AI and data center growth is another sign-post that is gaining momentum. The countries that can support this through clean energy solutions, like nuclear, will lead the field.” — Cory Belyk

I own and have for more than a decade, EMX and Ivanhoe. I own, and have for years and years, Canalaska and enCore Energy.

Other uranium-cos I own include Laramide Resources LAM and F3 Uranium FUUU.

Looming Metals Superstars (Human Beings)

I met this week in SF with nat-resources fund manager Matt Geiger of MJG Capital.

Matt, one of a small crop of young future metals big-money nominees here at The Calandra Report, is deploying most of the fund’s cash for additional equity in worthy gold, copper, nickel, etc., explorers.

MJG‘s half-year updates are a gift. We discussed Heye Daun‘s Koryx Copper KRY, a relatively new explorer in Heye’s Namibia. We have covered it here at The Calandra Report.

I purchased a small stake in KRY, about $1,150 worth, at its fresh high of 93 cents USD; KRYXF in U.S.

“Heye has had a few solid wins (Osino Resources, Auryx Gold, Lumina Mining) in Namibia (and elsewhere in Africa and South America),” Matt says. “He’s probably on track for tycoon status.”

Also discussed, and owned at MJG: Kenorland Minerals KLD; Ridgeline Minerals RDG — both of those owned for years-long stretches here at home.

Young Zach Flood at Kenorland also gets a tag here along with Matt for big-metals money status in coming years.

Chad Peters, Ontario geologist who now lives with his gorgeous family in Reno to run miniscule yet well funded and partnered Ridgeline, could get branded as “breakaway” if one of three exploration projects (or is it four?) deliver potent drilling Nevada silver, gold, zinc, lead headlines this autumn.

Neglected

I have to tag among companies I no longer update regularly (in the interest of keeping my current sanity markers intact) but are entirely worthy, and no they do not pay me, and some of these cats do not even subscribe: Vista Gold VGZ — still working, developing, grooming its Australia gold project); Summa Silver SSVR — active in Nevada and in New Mexico; West Vault Mining WVM — also a Nevada gold project developer.

Those that are steady this week or incrementally higher (some after heady gains in August and September thus far): Alamos Gold AGI; Xtra-Gold Resources XTG XTGRF.

(Xtra-Gold shares at $1.50 CAD, are at their highest price since December 2011 — and I have owned XTG XTGRF during peaks and valleys going back to 2009 or 2010.)

In a building stock pattern is Contango Ore — we own a slug of CTGO here at home. CTGO is an emerging Alaska producer.

An explainer online from its CEO here: https://contangoore.us2.list-manage.com/track/click?u=3959ed885041294f345de431d&id=ffbfc1f7ea&e=a372435a86.

We asked CEO Rick Van Nieuwenhuyse (pictured here) about partially hedged sales for the gold coming out of the Kinross Gold KGC Manh Choh partnership in Alaska.

“When the equity markets are crap (like they were last year and still are) and you want to build a mine your only alternative is debt. This Manh Choh is a robust project so debt made sense but the consequence is having to hedge some gold. That way the bankers make sure they get their money back.” — Rick Van-N at Contango

Spot and futures gold remain at or near all-time dollar highs. Approx. $2,680 an ounce in USD. È pazzesco (crazy)? Not really; overdue, yes.

Ditto silver (futures and spot) — now $32.50 an ounce, rising 5% this week. Copper is approaching $4.61 a pound in futures.

Our largest mining-co stakes, for 20 years, 15 years. 10 years and eight years in order of size and length of ownership: Ivanhoe Mines; Xtra-Gold Resources; EMX Royalty and Alamos Gold.

Derivatives — Strange Activity

TCRs, hedges unlinked to debt requirements can be harmful when gold is on a tear; derivatives activity damaged large and mid-sized gold producers in the middle and later 2000s years and into 2011.

This week, Chris Powell at GATA.org and others are seeing outsized derivatives trading in precious metals — by big banks.

Chris Powell references Wall Street on Parade, Pam and Russ Marten in his GATA.org explainer of unusual precious metals derivatives trading by banks:

“In an Office of the Comptroller of the Currency report, in the first quarter of 2024, federally-insured banks held $438.60 billion in precious metals contracts. That figure is at least 12 times greater than the amount the same banks held in precious metal contracts in any quarter from 2007 through 2018.”

Spec trek

Regarding the most speculative of our metals related companies: Comstock LODE, the Nevada silver-co turned metals recycler and decarbonization technology developer; LODE has tripled in price since mid-August to an $85 million market value. We own a small amount of LODE.

Finally (or not): a 3-minute video tour of CanAlaska’ Uranium’s West MacArthur exploration with Cameco CCJ. Cory Belyk and his top-geo, VP Nathan Bridge, outline the objectives that could (already have) moved CVV’s needle. Here.

Again, heady hits revealed at the venture’s Pike Zone — here please.

— Thom Calandra

PayPal $179 Yearly: Recurring The Calandra Report

PayPal $229 Yearly Non-Recurring The Calandra Report