First Mining Gold | Alamos Gold | CanAlaska Uranium

China real estate woes on one side of the world vs. a probable business boom in the West (see manufacturing report please Friday) continue to add to and subtract from a topsy-turvy metals market.

Copper prices are eroding — down 2% to its late April levels; platinum is one metal holding its recent gains. Gold, one day is teasing near $2,400 and the next downdraft flirting with $2,300.

“We’re at unbelievable low levels. The developers (of potential gold projects) are down 50% while the commodity is up 40%.” — Dan Wilton, First Mining Gold

Dan is 52 years old. In 2019, he took over as CEO of First Mining FF FFMGF and its 4.6 million ounce Springpole gold project, which is traveling toward its federal environmental assessment for the Ontario gold and silver deposit — probably in 2025. The gold price then was $1,300 an ounce.

“If you asked me then what our stock price would be when gold hit $2,300, I’d say in the dollars and I might be retired,” he shares. The $110 million CAD FF is 12 cents CAD.

The British Columbia-based exec and I discussed market dilution through equity placements for small mine explorers, a subject that he gets grilled on — what with First Mining’s share count reaching toward 1 billion. The metrics, Dsn says, show that FF’s peers are double and triple the 70 percent ‘dilution’ that Dan helmed from 2019 to 2024.

They include, he said, Troilus, Sabina (eventually purchased), Osisko Gold, O3 Mining. “Skeena has increased 270% 2019 to 2024 in share count … Troilus is 448%.”

Gold Market Comment

“Gold has yet to fulfill the predictions of a deep sell-off to lower support levels that many analysts have been promulgating on social media. That may yet come, but I assure you that no one knows whether it will or not.” — Writer Brien Lundin, New Orleans

No one? That sounds probable — thanks Brien.

Trading note for TCRs:

TCRs, I intend to start simplifying our holdings here at home.

Let’s call this (northern hemisphere) summer solstice simplifying. At any rate, I intend, in addition to completed sales noted below, to pare several stakes in resources companies. I will continue as always to track them. Or try to.

The ones I have identified, some in the money and some out of the money, include Nuclear Fuels NF, Azimut-Exploration AZM, Stuhini Exploration STU, Metalla Royalty MTA, several others to be named.

As always, I will keep TCRs informed.

Personally, I continue envisioning (and thus far being denied) plentiful, rapid gains for small titles (sub-$ 1 billion). Which include the ones that uncover solid tracks of copper, gold and so on. Coveting I know.

Reversals All Around

The cash if you want to know will be going into outpacing miners Alamos Gold AGI, Ivanhoe Mines IVN IVPAF and Xtra-Gold Resources XTG XTGRF. They lead the hit parade. Ivanhoe Electric IE is worthy yet cuckoo-trading — I own it and look to buy back more lower-priced (I pray) IE shares that I sold earlier. Into physical metals trusts; maritime; we’ll see.

Each of those stalwarts here has been “in the money” for years, held for years (and a decade-plus in the case of IVN and XTG), and they account as a group for between 50% and 55% of our securities holdings.

July and August will see the smallest mining stocks (remember them?) rebound in a big way. That simply … and for multiple reasons.

Leading drive: record net income from record production revenues. That for gold, copper, silver producers.

I especially love and own the hardest-hit roy-cos — EMX Royalty, for one; I also own Elemental-Altus Royalties ELE, Val-d’Or Mining VZZ, Kenorland Minerals KLD (Frôtet royalty). I will even buy back any sold Metalla Royalty & Streaming MTA shares if the stock descends to $2.75 USD or so.

Trading: after this report was published Friday June 21, 2024, and just before North America market close, I sold my NF, some of the AZM, the STU, some of the MTA. Rest assured, all of those titles have execs and geologists I trust, otherwise I would not be in them.

This week and last, as reported, I sold a quarter of our long-held Osino Resources at a profit. OSI OSIIF says the final Namibia approval for the China-co’s purchase of Osino might not come until later this summer 2024.

Sold at a loss $350 USD of NF NFUNF Nuclear Fuels — about a quarter of our stake in the Wyoming explorer.

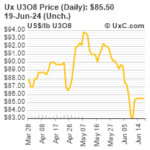

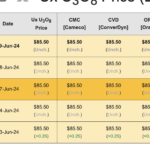

Uranium Feedback

These are from our trusted sources as the uranium spot price performs its own June swoon. (Translation: most uranium stocks are losing their once rebounded ground.)

“This is a temporary softening of both the U price and related equities; there is no shift in global fundamentals,” says Cory Belyk of CanAlaska Uranium CVV. “As a result, I have been in the U-market buying CVV and some others because I see these equities as undervalued … and I am in it for the LONG.”

Laramide Resources’ Marc Henderson LAM: “Nuclear in the media is starting to drive generalist interest. AI needs lots and lots of cheap, reliable power.” They are in New Mexico, Australia.

Daniel Major of GoviEx Uranium GXU: “I do not think the sector had fully priced in the U-price increase in the first place and GXU is not even pricing in our Zambia project.” GXU is also in coup-rattled Niger.

I own five uranium explorers and a producer-explorer, enCore Energy EU. They include from above, here, and from below the ground, too: Canalaska Uranium CVV; Laramide Resources LAM; GoviEx Uranium GXU. F3 Uranium FUUFF, also Athabasca Basin in the great north; ditto Skyharbour Resources SYHB SYHBF.

This entire report online for subscribers here please.

More The Calandra Report here please. — Thom Calandra

PayPal $179 Yearly: Recurring The Calandra Report

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.