Bravo Mining’s Copper — Brazil | C3 Metals’ Copper — Jamaica

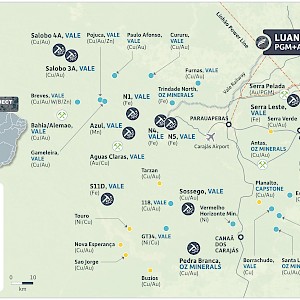

Matt’s reasoning: a massive sulphide copper assay just released; plenty of cash; another “crucial†assay probably a week away; aggressive and big investors in the stock; politically connected Brazilian mining exec Luis Azevedo. Luis, a lawyer, has been behind at least three mining start-ups in Brazil. He owns 50 million shares of Bravo. |

Boilerplate background above is linked. Bravo is a $350 million CAD market value in Toronto.

Trading DHT Maritime | Ivanhoe Electric | Bravo Mining | C3 Metals

*Trading note: As mentioned, purchased Bravo Mining, and with a third order Friday June 7, 2024 in but not fulfilled. [Update: that order accomplished — and now a total of $5,100 USD of BRVMF.]

As discussed, I sold approx. $15,000 of DHT Maritime to pay for the trade. That is half of our long-held and profitable DHT stake. Saudi Arabia’s Aramco is lowering prices for oil sold to Asia for July 2024 — first cut in three months. Still, Aramco sees China demand growing going out a year. The oil company says it will increase its premiums for oil to Europe.

“This time of the year is usually very weak regarding spot shipping rates. Estimation of the current spot rate is (on average) just above $40,000 per day. I will be waiting for some weakness to start buying back my DHT shares.” — Avraam Gabrielidis in Greece regarding DHT Maritime

C3 Metals: I added to my 2-year stake of CCCM CUAUF. Dan Symons‘ latest and lengthy copper porphyry (with gold) assays at Bellas Gate did not move the CCCM CUAUF needle one iota. We are talking several hundred meters of intercept in the latest results and another 79 meters in the previous one.

“We have hit porphyry mineralization in drill holes at the Provost, Connors, Camel Hill and Geo Hill prospects,†Dan, CEO, tells me. “In some cases, we can see outcropping intrusive diorite cutting through the older andesite volcanics. In other cases, the intrusive does not outcrop but the same geochem/geophysical anomaly is present.â€

This C3 is a $22 million CAD market value for CCCM. I have toured Bellas Gate in Jamaica.

Friday (June 7 2024), as most mining stocks in North America and in Europe dropped 3% to 6%, I added at lower prices Ivanhoe Electric IE.

|

PayPal $179 Yearly: Recurring The Calandra Report

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.