Updates: Azimut | Power Nickel | Fireweed | Platinum Group Metals

Shares of an ignored Canada merchant bank‘s two portfolio companies are gaining sharply in thick trading.

Both are copper-gold explorer-potential developers, one in central British Columbia and the other in northern Québec; one released drill assays and the other a resource update.

TAGS

Platinum Group Metals PTM PLG

Snowline Gold SNWGF SGD

Fireweed Metals FWZ FWEDF

Azimut Exploration AZM AZMTF -- all below

QC Copper & Gold QCU QCUUF, whose Stephen Stewart in Toronto eschews promoting with no fresh news, says its Quebec project, Opemiska, now has 1.75 billion lbs of copper, 845,000 ounces of gold and some silver. Release here please.

Opemiska once was a Falconbridge mine.

The chairman, CEO and an active investor, Stephen calls it Canada’s highest-grade open-pit deposit at 0.77% copper with a 0.15% cutoff. He owns 5% of QC’s shares and his chaired, publicly traded merchant bank ORECAP Investment Corp. OCI, owns 4%. See OCI holdings here please. YouTube wrap here please.

[Also, please see how OreCap in November 2023 helped American Eagle through its 2-cent-a-share slog one year ago — below.]

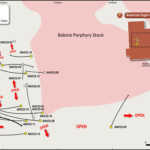

The other holding, a larger one at 11% for OreCap, is American Eagle Gold AE, and its stock Monday is going through the roof with this hole at the British Columbia NAK project: 302 meters of 1.09% copper equivalent with gold (within 606 meters of 0.74%). Just copper without gold is 0.4%.

Shares of the three are all up smartly in trading that is 30 to 60 times average daily volumes. American Eagle shares are up 50% before the close as more than 5.5 million shares change hands.

Anthony Moreau, CEO of American Eagle Gold, says the headline hole, NAK23-17, is a”stepout” in what is a lightly drilled project.

He calls No. 17 a “bold” stepout, approx, 250 meters from any other hole. “We wanted to see strong mineralization a distance away from other holes with drilled copper.” See September and October 2023 drill assays here please.

“We always believed in the stepouts,” Anthony says. YouTube wrap here please.

Teck Resources owns 19.9% of American Eagle’s shares with no right of first refusal regarding other companies participating in share placements.

Boilerplate for the merchant bank

Orecap’s current holdings

- American Eagle Gold (AE: TSXV): 11.8 million shares (10.9% of shares out.)

- QC Copper and Gold (QCCU: TSXV): 5 million shares (2.9%)

- Mistango River Resources (MIS: TSXV): 24.7 million shares (13.9%)

- Awale Resources (ARIC: TSXV): 8.3 million shares (14.8%)

- Cuprum Corp. (PrivateCo): 29.5 million shares (42.7%)

I do not own shares in any of these. In the case of American Eagle, investors might be heartened by Teck Resources‘ two investments in the company, both at premiums when the investments took place last year.

“We are getting calls today from institutions that are more comfortable investing at 50 cents (CAD) then when the shares were 25 cents,:” Anthony Moreau says. The stock, AE, is now 40 cents CAD after notching 50 cents earlier in the day.

As for the November 2023 call option transaction between OreCap and American Eagle tagged above:

One year ago, ORECAP owned flow-through placement shares in AE.

Stephen Stewart of ORECAP explains, “You can only reallocate flow-through at the asset level. At the time, American Eagle was drilling … but its share price was 2 cents, and it wanted to expand drilling. Each company had a problem, and together, in effect, Orecap lent American Eagle $1 million in exchange for a 20% interest in the NAK project. AE had the right to re-purchase this 20% at any point in time over the next 18 months for $1.5 million.”

ORECAP it turns out netted an extra $500,000 CAD from the transaction in AE shares; American Eagle didn’t have to finance at 2 cents.

AE AMEGF shares have a market value of $30 million USD and as stated, before the Monday close in North America, are rising 50%.

Tuesday update

I spent time on a Zoom call with Power Nickel‘s Terry Lynch. The explorer PNPN PNNF has its NISK project about 8 km outside the Québec town of Nemaska. The company today said it raised $2.2 million CAD in a flow-thru equity sale with half-warrants. Terry says he and friends-family largely comprised the $2.2 million. The release has many of the details we discussed, including addition of a second drill rig at NISK, off-take discussions with other nations, a royalty sale in the works and a possible Chile spinoff.

Dirt cheap at $28 million USD market value, Power Nickel shares thus far I do not own. Terry Lynch heads a group that is protesting the practice of “naked” short selling, or trading imbalances. See release here please.

Robotic chart analysis: PNPN is showing strength within a longer-term bearish trend. Its MACD is above the signal line and shares are presently 2.6% above the 200-day moving average. However, that moving average is declining, implying that caution is still warranted.

These others are showing strength thus far this week in a sideways junior mining market:

Platinum Group Metals PTM PLG — possibly due to December’s news of a Saudi Arabia smelter initiative for the South Africa developer.

Snowline Gold SNWGF SGD A week ago, this release re-launched the Yukon developer’s shares: 2.2 gram-gold grades in shallow ground with lengthy intercepts. Snowline shares Tuesday understandably given its powerful rise early this 2024 are giving up some of those price gains; I expect Snowline shares eventually will notch a $1 billion CAD market value.

Quinton Hennigh, the Crescat Capital geologist-adviser who championed Snowline’s Valley Project (Rogue, etc. targets), launched Crescat’s ownership with his research in July 2021.

Crescat owns approx. 10.2 million shares and 1.2 million warrants as of Dec 31, 2023, Stephanie Hansen of Snowline says. There are 140 million Snowline shares outstanding, at last look.

With warrants likely to be exercised, Crescat could see its Snowline stake rise.

Fireweed Metals FWZ FWEDF Like Snowline, another Yukon machine when it comes to grades, intercepts, true widths at its Macmillan Pass zinc-lead-silver project. Tuesday, another potent dose, including 14.4% zinc across 144 meters.

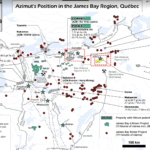

Azimut Exploration AZM AZMTF The holder of multiple Québec mineral concessions (see map here please) and a predictive modeler, Azimut saw its shares Tuesday get a needed lift from its first lithium hole results at James Bay. In partnership with Québec mining investment entity SOQUEM, Azimut reported 2.48% lithium oxide over 73 meters.

Of interest is CEO Jean-Marc Lulin’s release stating Azimut expects its Galinée property, “based on visual examination of the drill core,” to spawn “other significant lithium intercepts.” See images here please.

The shares’ flurry tempered in the Tuesday trading day.

— Thom Calandra [I own Azimut, Platinum Group Metals.]

PayPal $249 Yearly Non-Recurring The Calandra Report

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.