‘Golden Triangle’ Project’s Angles Might Not Total 180°

International researchers at the University of Northern British Columbia say many of western Canada’s glaciers will melt off by year 2100.

Tudor-Gold and its Treaty Creek gold-silver-copper spread, hanging on a glacier in British Columbia’s so-called Golden Triangle, might disappear well before then.

I have been in contact with Ken Konkin, CEO-geo, and spokesman Chris Curran, both Vancouver, BC, area residents. See below please.

A flock of geologists, engineers and financiers up there in the rugged and year-round glacial peaks of northern BC, and those elsewhere in The Calandra Report/TCR‘s roster, tell us Tudor’s Goldstorm ‘deposit’ will be a ”train wreck” and ”a disaster in the near future.”

Also: “Possibly a black mark on the mining industry in its presentation of ‘independent’ resource estimates.”

One executive said “an open pit there, with scant meaningful intersections at 500 meters, would need $4,000 gold” to become economic and financeable.

Another: “The notion of block-cave mining below a pit is outlandish. The tailings alone, not to mention initial cap-ex, would run to $2 billion or more.”

“No chance of becoming a mine as an open pit, underground or a combination thereof.”

Tudor (TUD.V) has a market value and enterprise value of $200 million CAD. The other owners of the Goldstorm Metals project are Teuton Resources (20%) and American Creek (20%), both public. All trade shares at meagre volumes.

TUD TDRRF shares number many Germany investors, the estate of the late founder and market-moving Canada investor Eric Sprott.

Goldstorm’s 43-101 (March 2023) Mineral Resource Estimate outlines an Indicated Mineral Resource of 23.37 million ounces of gold equivalent within 641.93 million tonnes (Mt) at a grade of 1.13 g/t gold-equiv., including an Inferred Mineral Resource of 7.35 ounces GE within 233.90 Mt at an average grade of 0.98 g/t GE.

That part of upper-BC is one of the busiest mining districts in Canada these days. Around the city of Terrace, the municipality of Stewart and the winding, ruggedly scenic Skeena River and Basin, explorers, mine-builders, natural-gas and oil pipeline crews, road builders and power-line installers. Fishers of every type of salmon; and vacationers, too.

Tudor-Gold’s 2021 and latest 2023 resource estimates from two separate engineering firms differ considerably. Most outsiders wonder why the company keeps saying it will print a prelimnary economic assessment yet has none to date.

Outside observations and Tudor-Gold responses (and I will be adding to these all this holiday weekend):

Query: The 2021 Report suggests metallurgical recovery of silver of 30% (conventional flotation). In the 2023 Report, this has

increased to 80%. What is the justification for the increase? Chris Curran: “We are switching to pressure-oxide for 200 million ounces of silver … we haven;t done enough metallurgy.”

Query: The 2021 Report had a reasonable Measured Resource; in the 2023 Report, this has been eliminated and is now classified as Indicated and Inferred only. Chris: “It is a different geological model … this is a much tighter resource … more conservative. The second done by JDS, so a higher quality one.”

Query: It appears that the calculated cut-off grade has omitted to account for the cost of mining associated waste (a strip ratio of 8.6). Chris: “I totally agree with you on that one … we would never go with an 8.6 strip ratio … the costs would be very high. “So we could open pit the 300 level horizon at surface (gram of gold over 300 meters) … then a bulk tonnage block cave undernasth that at the CS600 or the DS 5 level is a good gold resource.”

Chris notes “underground block caving is becoming more dominant in the next 10 to 15 years. The costs are high yes but the sustaining csp is lower with no strip ratio.”

He and Ken Konkin say CS600 is the “superstar copper domain” with 0.38% copper and 0.7 percent gram gold, Across the entire resource, Tudor believes “the copper gets smeared, diluted by the overall volume of the ore.”

Says Chris Curran, “We are going to bring an additional 2.4 m oz of gold and 3 bln lbs of copper into Measured & Indicated.”

As for angles here, many believe a dip of 44 degrees poses challenges never met by large block-cavers, but for two. Response: “In some cross sections, the CS600 may appear to dip 45 degrees as you suggest, however the zone is still 500 meters wide (over 5 football fields) and 1,000 meters long. The domain is absolutely huge. ”

Query: Pre-production capital costs for a block cave operation? “I can’t give you an answer. We are hopeful we can have a PEA by next year. We want the entire mapping first.”

Ken Konkin, CEO, addressed metallurgical and other concerns.

“We are still looking for the center of mass for Goldstorm so we can take a complete selection of samples for metallurgical and comminution tests that will be part of our feasibility study. We will embark on a Preliminary Economic Study once we know the final shape and grade distribution of our various metals within the various domains.”

Ken explains, “The most advanced studies have been on CS600 as that domain is a straight-forward flotation system that we think will have a saleable Cu-Au concentrate. The goal with our end-member Au-dominant domains, Copper Belle (pretty name but has no copper), 300H and DS5 will probably be either Albion, POX or possibly Bio-leach recovery processes as that latter process worked well with our studies on a very similar ore to the south of our Goldstorm Deposit.”

“Although we currently have an updated resource published at 23.4 million gold-equivalent ounces at 1.13 grams per metric ton, we clearly have a mine within a mine that is rapidly expanding within our CS600 domain. We’d like to expand our domains in the northern aspect of the deposit that support our 1.0 gpt gold-equivalent cut-off, which averages 1.48 gpt AuEq for more than 15 million gold-equivalent ounces.”

TCRs, I will be adding more detail and responses, comments. I have no intention of owning Tudor-Gold shares nor short-selling them. The trading volumes are too thin; the market value at $200 million CAD is more than double suitable exploration-development peers in BC.

Also: Do not know if all of you caught Contango Ore‘s 67,500-ounce share of Kinross’ Manh Choh Mine gold output in Alaska.

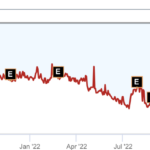

I have been buying CTGO shares for more than a year since seeing Contango’s Lucky Shot project, also in Alaska: all the way into the $30s and now down to the $18s.

The partnership for Contango will pencil out to yearly ‘free’ cash flow of $55 million; production starts later this year.

I asked Rick Van Nieuwenhuyse when the numbers came out this week just how. “Silver only makes up a small percentage of the bullion so it is 95% gold weighted. The free cash flow for Contango from mining operations once in full production will average 67,5000 ounces – our share of average annual production. All-in-sustaining-costs are estimated at $1,116 per gold-equivalent ounce, leaving a free cash flow margin of $825 at today’s $1,941 gold price.”

That number when fully achieved will put yearly free cash flow at $55 million USD. Approx. 9.9 million fully diluted, all-in shares, ergo $5.50 a share for CTGO on NYSE AMEX.

— THOM CALANDRA

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.