This report: Aston Bay Holdings, Stuhini Exploration, Aztec Minerals, Alaska Energy Metals, others.

Obscure mining-cos (approx. $100 million market value and lower) are entering a summer-autumn scramble for fresh cash.

Many do not deserve it.

The $ub-100s, as I label them, face larger explorer-developer-producers’ brokered equity placements, convertible debentures (BeMetals‘ $3.3 million CAD one), ‘bought’ equity deals guaranteed by banks, secondary sales (outside Canada), strategic investments (lithium’s Albemarle sending $109 million CAD to Patriot Battery Metals) — here is a Junior Mining Network list worth a scan.

[Please see also: Financing ‘Bloodbath’ Ahead? The Calandra Report/TCR]

Still, mom-pop, non-brokered equity offerings can succeed in this evaporating investment climate for metals. They require patience and lots of personal connections, hopefully with wealthy friends.

Or in some cases, Arizona and Mexico explorer Aztec Minerals AZT AZZTF for one, in dribs and non-brokered drabs; this week, Aztec says it will try for $1 million CAD. See statement. In February, with help from 15% owner Alamos Gold: $1.3 million. AGI

Let us also refer to: ‘too quick to pull the trigger’ equity offering/1-for-4 share shrinkage — Aston Bay Holdings BAY.

A Nunavut copper discovery, far-northern Québec geos tell me, might be vast; but this is second-hand.

Aston Bay, some 20-million-plus BAY shares traded last week, saw its shares eclipse a previously announced and much-needed private placement dash for cash. Thus, Aston Bay’s board put on the brakes. See Aston Bay release please.

I traded in and out of Aston Bay shares for a one-week, 55% profit of about $900 USD. I sold after reaching out to CEO Thomas Ullrich, a geologist, several times and getting no response. That is why I say, above, ‘second hand.’

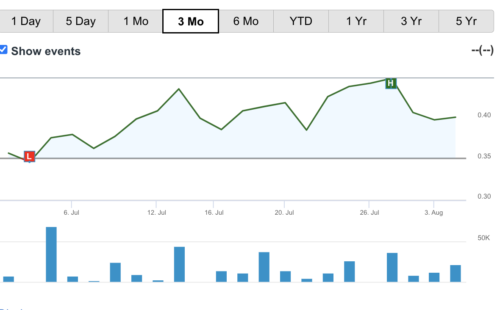

The stock lost almost half its gains until today (Wednesday August 16, 2023). BAY ATBHF shares are making up their sacrificed gains and setting all-time highs — see chart please .

So, aside from the work commitments and cash, why else did Thomas Ullrich and board sacrifice 80% of what it calls Storm Project to an Aussie company a few years back?

Larger partner American West Metals AWMLF and Aston Bay shares each were doubling since a week-ago Monday’s copper-discovery proclamation and images.

Expect Thomas Ullrich and board to return to its share-shrinkage plan to erase a sloppy, ballooning BAY share count soon, and to unleash a renewed summer equity offering at 30-cent-plus CAD prices.

Alaska: Greg Beischer renamed his $20 million CAD Alaska gold explorer Alaska Energy Metals AEMC AKEMF, shrunk the share count and, after a couple of months of emails, calls, Zooms and investment shows, notched $6.4 million from a brokered stock sale and approx. $3 million CAD (both just closed) from a non-brokered ‘sidecar’ offering. See statement please.

Like most $ub-100s, Greg used half-warrants and paid brokerage commissions and some finders’ fees. See: Money For Alaska’s Nikolai nickel, cobalt, platinum-etc project.

One positive of a share consolidation in Greg’s strategy is that robo-analytics show AEMC as of today-Monday August 7, 2023 (Canada holiday) as “correcting within a longer-term bullish trend. Although its MACD is presently below the signal line, shares remain 27.9% above an upwards sloping 200-day moving average. Comparative Relative Strength analysis shows that this issue is outperforming the S&P 500.” For what that is worth, you chartist TCRs.

Greg tells me his lead agent was Emerging Equities of Calgary. Also working with Alaka Energy Metals were Echelon, Cannacord, Red Cloud and Cormark as syndicate members.

Alaska Energy Metals did the $3 million CAD non-brokered one to accommodate a long-standing investor, Redplug Capital from Vancouver, and U.S. subscribers.

The sentiment part of raising money in an industry not named AI, and Generative Pre-training Transformers, or semiconductor chips is what most interests me in the scrum for capital this 2023 summer.

“It’s gratifying to raise this money in a moribund market in the middle of summer. We are almost certain the nickel is there st Nikolai based on historic drilling. We just have to prove it and we are doing that now with grid drilling.”

The dynamic: a secure supply of nickel for America’s electrical energy transition; a fresh generation of nickel deposits that are bulk mineable, with lower metal content. Probably the only way the industry can meet demand for “energy” metals.

“To me it’s a similar paradigm shift that copper mining went through in the 1950s. Huge demand forced us to mine copper porphyries and this was facilitated by process technology changes – SX-EW” That’s geologist-lingo for cathode copper technology: leaching copper ore heaps by means of diluted sulphuric acid.

Sentiment from other obscure explorers that I have managed to ignore for months on end.

One is David O’Brien of Stuhni Exploration STU STXPF in upper B.C. at Atlin.

David has the Ruby Creek gold project near Atlin and a “shovel-ready” molybdenum deposit — a pit-constrained measured and indicated resource of 433 million pounds of moly.

Moly is used as an alloy and can be unearthed in copper deposits.”It’s one of the best performing of the base metals since 2020,” says David, who is, I believe, a straight shooter, albeit one with sn $11 million market worth and an evaporating share price.

“When we first optioned the project in late 2019, the price of moly was under $10 a pound USD. In early 2023, the price ran from $17 to $35.” Voilá: two financings and now $2 million CAD cash in the bank. Current moly price is$23 a pound.

Here is s link to the freshest molybdenum statistics from International Molybdenum Association: Please see report.

Moly trades in contracts on London Metals Exchange.

— Thom Calandra

Thom Calandra is a writer and an investor. Research and material are meant as editorial opinion. He is not a professional investment adviser. Please do not consider his reporting as a recommendation to buy or sell securities.